Cuyahoga

Small

Business Development Center

at the Urban

League of Greater Cleveland

Presents

Do

you believe foreclosure errors cost you money?

| |||

| |||

|

* Any payments made to you if errors in your

foreclosure are found may be reported to the IRS and may have tax implications.

Consult a tax advisor to discuss those implications.

If you are

currently represented by an attorney at law with respect to a foreclosure or

bankruptcy case regarding your mortgage, please refer this email to your

attorney.

|

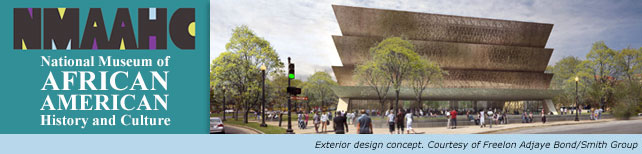

| Changing America: The Emancipation Proclamation,

1863 and the March on Washington, 1963

Opens

December 14, 2012

NMAAHC Gallery at American History, second floor east

On August 28, 1963, at the March on Washington,

Martin Luther King Jr. began his speech by declaring, "Five score years ago, a

great American, in whose symbolic shadow we stand, signed the Emancipation

Proclamation. This momentous decree came as a great beacon light of hope to

millions of Negro slaves who had been seared in the flames of withering

injustice. It came as a joyous daybreak to end the long night of captivity ...

In a sense we have come to our nation's capital to cash a check."

In 2013 the country will commemorate two events that

changed the course of the nation — the 1863 Emancipation Proclamation and the

1963 March on Washington. Standing as milestone moments in the grand sweep of

American history, these achievements were the culmination of decades of

struggles by individuals — both famous and unknown — who believed in the

American promise that this nation was dedicated to the proposition that "all men

are created equal." Separated by 100 years, they are linked together in a larger

story of freedom and the American experience.

To commemorate these two pivotal achievements, the

Smithsonian’s National Museum of African American History and Culture (NMAAHC)

in collaboration with the National Museum of American History (NMAH) will

present an exhibition, featuring historic photographs, paintings, new film

footage and objects, that explores the historical context of these two crucial

events, their accomplishments and limitations, and their impact on the

generations that followed.

The exhibition

will be on view from Dec. 14, 2012 through Sept. 15, 2013 in NMAAHC’s temporary

gallery on level two at American History, 14th St NW and Constitution

Ave NW. Metro: Smithsonian or Federal Triangle.

For more information, visit www.nmaahc.si.edu.

|

| Claiming Tax Refunds, Protecting Tax Cuts | ||

Good communication is important, and poor

communication can be costly. Unfortunately, miscommunication between Washington

and Ohio could cost families in Wilmington and Orville up to $3,700 next year.

As the New Year quickly approaches, it’s critical that Ohio families are aware of the unclaimed tax refunds that may be owed to them by the Internal Revenue Service (IRS). Often times, inaccurate addresses have caused these funds to be returned by the U.S. Postal Service. And in fact, last year, more than 2,000 Ohioans were eligible to claim tax refunds. In 2011, undelivered refund checks were worth more than $1,500 on average. Ohioans have always worked hard and played by the rules. But every year, millions of Americans don’t receive their tax returns because of postal errors. Taxpayers deserve to easily receive the money that the government owes them, and shouldn’t lose money just because their checks got lost in the mail. Fortunately, claiming a tax refund is an easy process if you are eligible. According to the IRS, if a refund check is returned to the IRS as undelivered, taxpayers can generally update their addresses with the “Where’s My Refund?” tool on IRS.gov. The Tool also enables taxpayers to check the status of their refunds. A taxpayer must submit his or her Social Security number, filing status, and amount of refund shown on their 2011 return. The tool will provide the status of their refund and, in some cases, instructions on how to resolve delivery problems. Ohio taxpayers checking on a refund over the phone will receive instructions on how to update their addresses. Taxpayers can access a telephone version of “Where’s My Refund?” by calling 1-800-829-1954. They can also go to the Where’s My Refund? online tool to check the status of their refund by clicking here. Ohioans can also take two simple steps to avoid the risk that their refund could get lost in the mail. They can start by signing up to have their tax returns directly deposited to their bank accounts, eliminating the potential for postal errors. Next, they can file their taxes electronically. In addition to reducing the potential for miscommunication, e-filing reduces errors on tax returns and speeds up the refund process. But while ensuring Ohio families receive the refunds they are owed is important, it’s also crucial that we fight to guarantee middle class families across the country don’t see their taxes rise altogether. Right now, taxes will automatically rise for all Americans on January 1 unless Congress acts. Both the President and I campaigned on maintaining tax rates for 99 percent of Ohio families, and on November 6th, you strongly supported this position. But, more than a month later, some conservative politicians in Washington still haven’t gotten the message. They are still protecting the wealthiest one percent, at the expense of the middle class. In July, the Senate passed the Middle Class Tax Cut Act, which would prevent 99 percent of Ohio families – and all Americans making less than $250,000 per year – from paying higher taxes. Under the bill, the median income Ohio households would save an average of $2,200 on their taxes next year. Leaders in the House of Representatives have failed to schedule a vote on the bill – in part, because it asks the wealthiest two percent of American households to pay the same tax rates they paid during the Clinton years, when our economy added 22 million jobs. It’s time for the House of Representatives to stop holding hostage middle class tax cuts and pass the bill. It’s our duty to ensure that taxes will not go up for the millions of Ohioans who wake up early, send their children off to school, keep our assembly lines productive, tend to our vast agricultural areas, and stand up behind a counter serving customers for eight hours or more each day. Let’s move forward with our economic recovery and ensure that Ohioans have the resources they need to support their families. By accessing unclaimed tax credits, and providing tax cuts that bolster middle class families, we can continue to make our country stronger. Sincerely,  Sherrod Brown U.S. Senator |